Where there are 2 or more funds in a portfolio of the same asset grouping the portfolio optimisation from the fund solver may use only 1 or some of the available funds.

Portfolio optimisation depends on a range of factors including:

- investment term

- risk budget - what risk level is being targeted?

- asset mix - are the similar funds coming through as 100% the same asset class in our system or do they have different constituent assets and asset weights?

- charges - is one fund more expensive to invest in than the other?

- Constraints

The optimiser looks at the risk-return trade-off of the investment strategy, taking diversification effects into account, to arrive at the optimal portfolio.

We operate at the broad asset class level; we do not/cannot distinguish between 2 flavours of UK equity funds, for instance. If both funds come through as 100% UK equity, then the optimiser will prefer the one with the lower charge. Most funds do not have 100% in a single asset class however and so this variation impacts the optimisation.

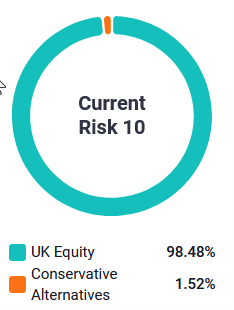

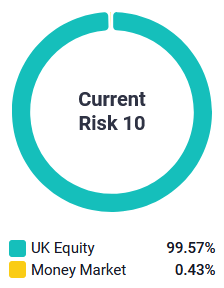

As an example, these are the asset allocations of 2 UK Equity funds.

Fund A:

Fund B:

Although they are both nearly 100% in the UK Equity asset class, the variation between them could result in one of them being included by the optimiser whilst the other is not.

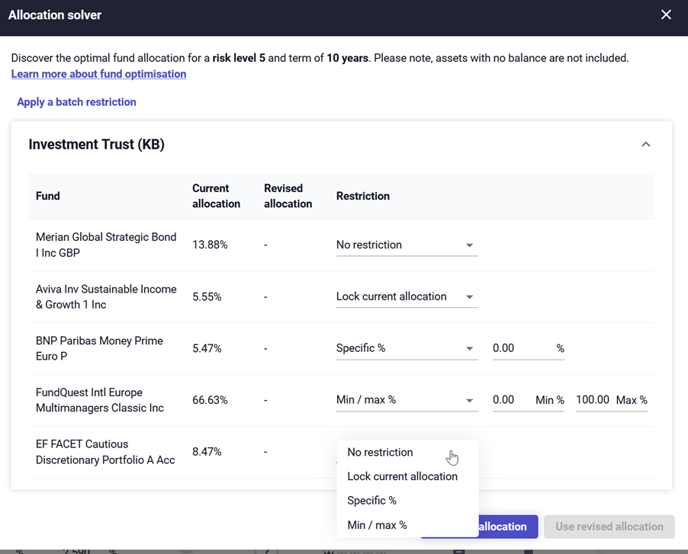

If you have preferences to invest in particular funds, you can enforce them via Restrictions, noting that may reduce efficiency from the model's point of view as they can hinder the search for optimal portfolios in particular directions.

To include a fund which is not being included by the optimisation or include multiple funds within the same sector you can set a minimum value against the relevant funds.