If you have created joint clients in EVPro, you can complete a Risk Questionnaire on each of them individually.

Moving onto the Goal module, it is possible to create 2 revised plans (one for each of them) and then look at their individual assets/expenses/Income etc by removing the partner's records. You would just need to choose what needs to be done with any joint records.

Create the seconds life's retirement event before creating the revised plans and ensure that all the assets/incomes/expenses etc that have an end date that may coincide with this date are set up.

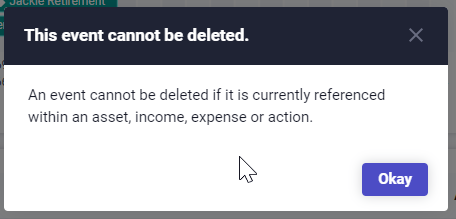

When the second life's revised plan is then set up, the first life's retirement event can be deleted. If any items still reference the first life's retirement event, it will not be able to be deleted - this message appears:

The mortality event for joint lives will be the estimated age when the last survivor passes.

Please note: if using the migration option, clients will need to be worked on individually as they are migrated individually.