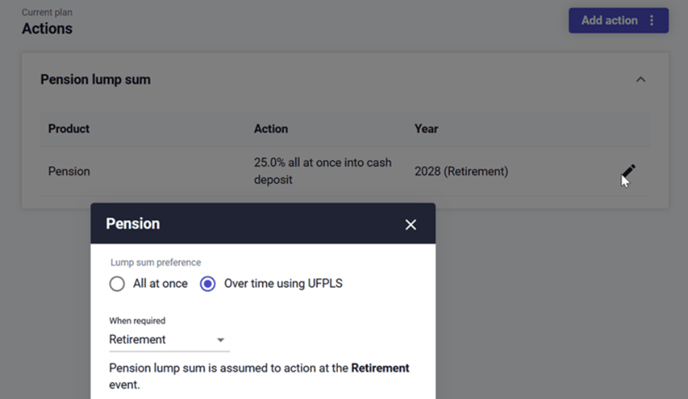

EVPro can draw an income from tax free cash via UFPLS. This can be set in the Actions tab within Current plan/Revised plan. Clicking on the pencil icon for the pension will allow you to switch from taking all the tax-free cash at once to over time via UFPLS.

However, it is not possible to specify how much to take via UFPLS in EVPro, rather it will draw the appropriate amount over time.

If you are looking to specify the amount of income being taken from tax free cash annually then a possible approach would be that once you have calculated the value of the pension plan after the tax-free lump sum, you would to need to enter this as an income drawdown plan.

So, if you have £100000 invested in a pension plan, you would need to put £75000 into an income drawdown plan, to ensure it is taxed properly and no further TFC is given. Then set a non-taxable income with an end date when the £25000 would be exhausted.