When adding a client's salary, record the client's gross income excluding P11D benefits. If there are P11D benefits on which tax is paid, such as a company car / gym membership, this should not be added as Income as the client is unable to 'spend' this.

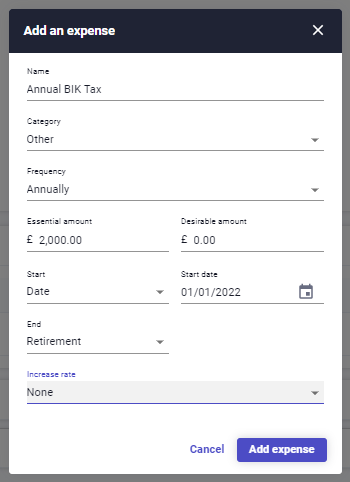

However, additional tax will need to be taken from the client's income to pay for these benefits. We recommend adding an expense for the amount of tax to be paid on the annual benefits in kind: