As long as the client has an idea of how much they would be planning to spend on a new home when the time comes to downsize then the following can be done to model this. We’ll use the following as an example.

John Brown has a property worth £900,000 and at retirement expects to downsize to a property costing £500,000. He does have a mortgage of £300,000 payable until he is 70.

- Two properties will need to be recorded. One for £500,000 (the cost of the new home) and one for £400,000 (the bit to be sold).

- To the property record that will be ‘sold’, add the mortgage.

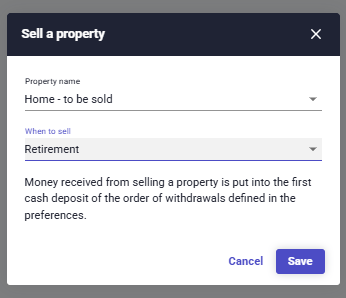

- Add the Action ‘Sell a property’ choose the record to be sold and add the date that this might be i.e., at retirement

What will happen is on the ‘Sell a property’ date, the system will see there is a mortgage and will clear that first. Any cash left over will be added to the first cash account recorded for the client and if there isn’t one, it will create one in the background.

To make you aware, EVPro will show the amount of the property being sold on the expenses chart as an income (in this case the £400,000), but if you go to assets you would see that it has taken the money from the house sale less the debt amount and paid rest into cash.