Assuming that we are looking at contributions to defined contributions schemes, let us give you information about how we deal with these.

Firstly, all Pension contributions should be entered Gross as we deal with these contributions on a Salary Sacrifice basis.

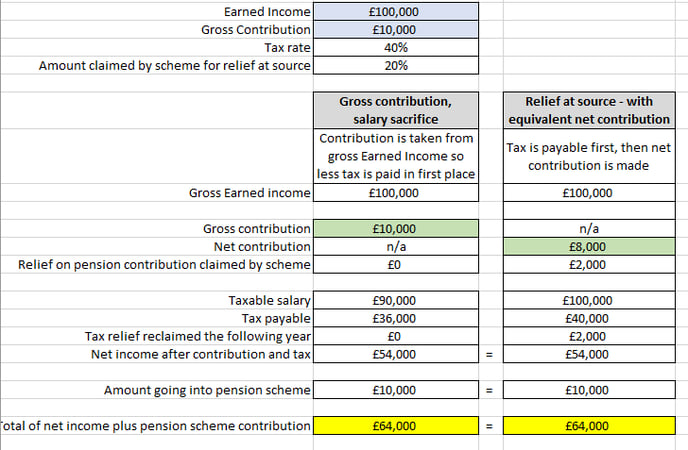

Using the simplified example below for a higher rate tax payer, we will show how adding a Gross contribution has the same net outcome for the client as receiving Tax Relief at source.

Please note: If you enter a pension contribution into EVPro for a client who has no earned income, there will be no tax relief given on the contribution.